2024 Income Tax Brackets And Deductions Over 65

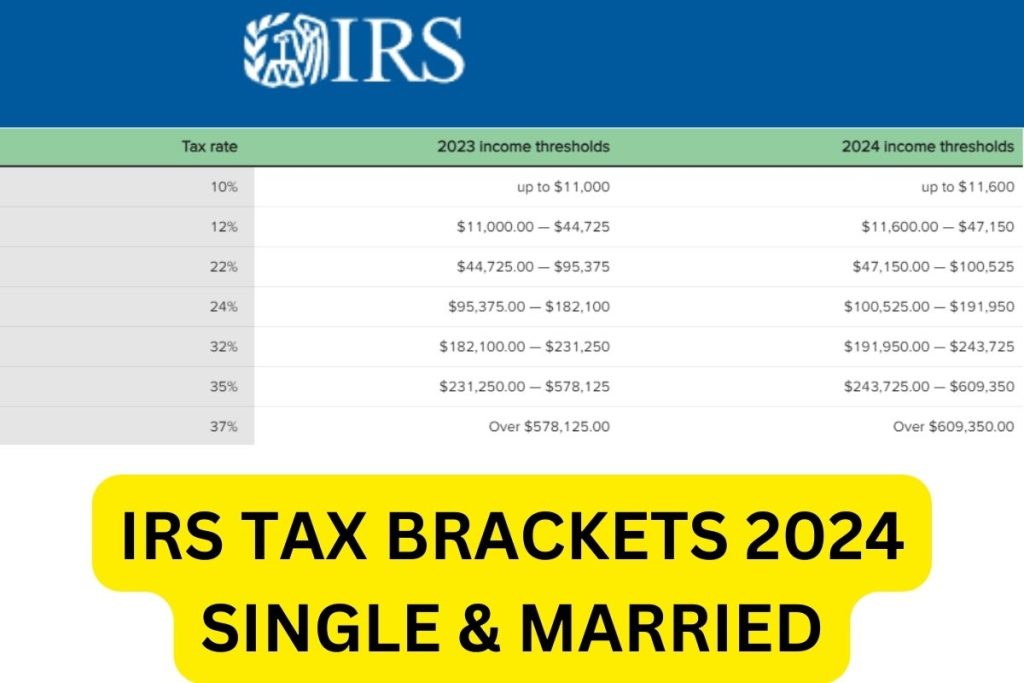

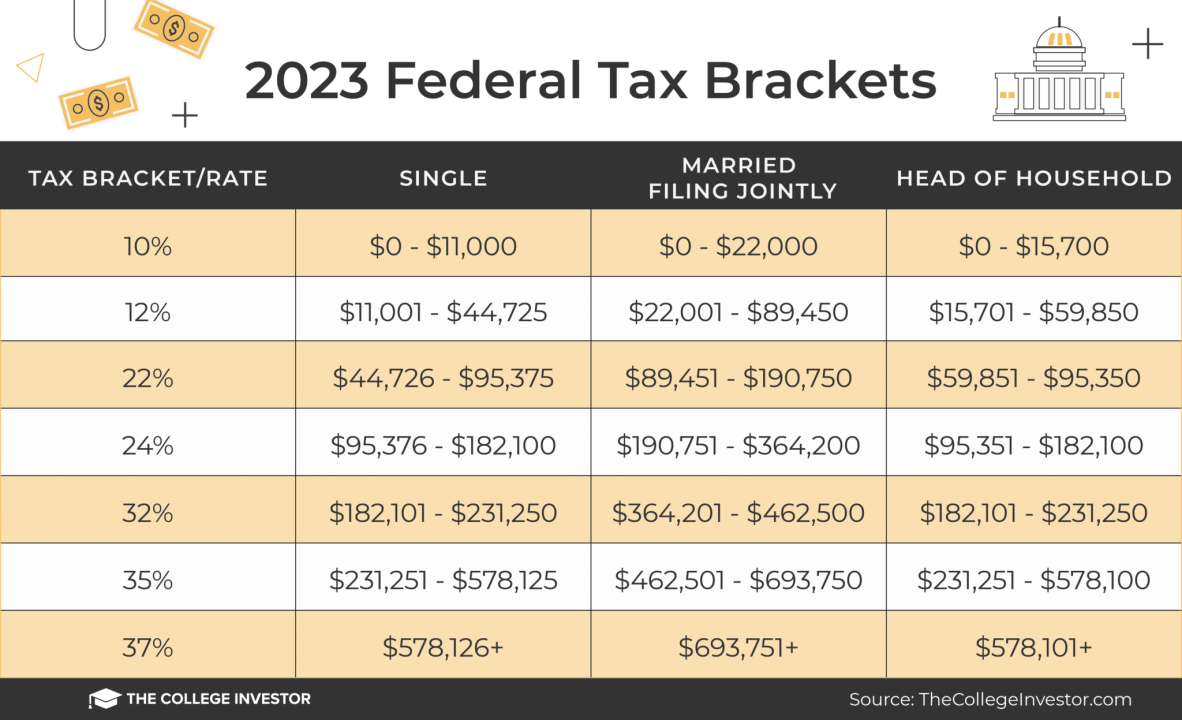

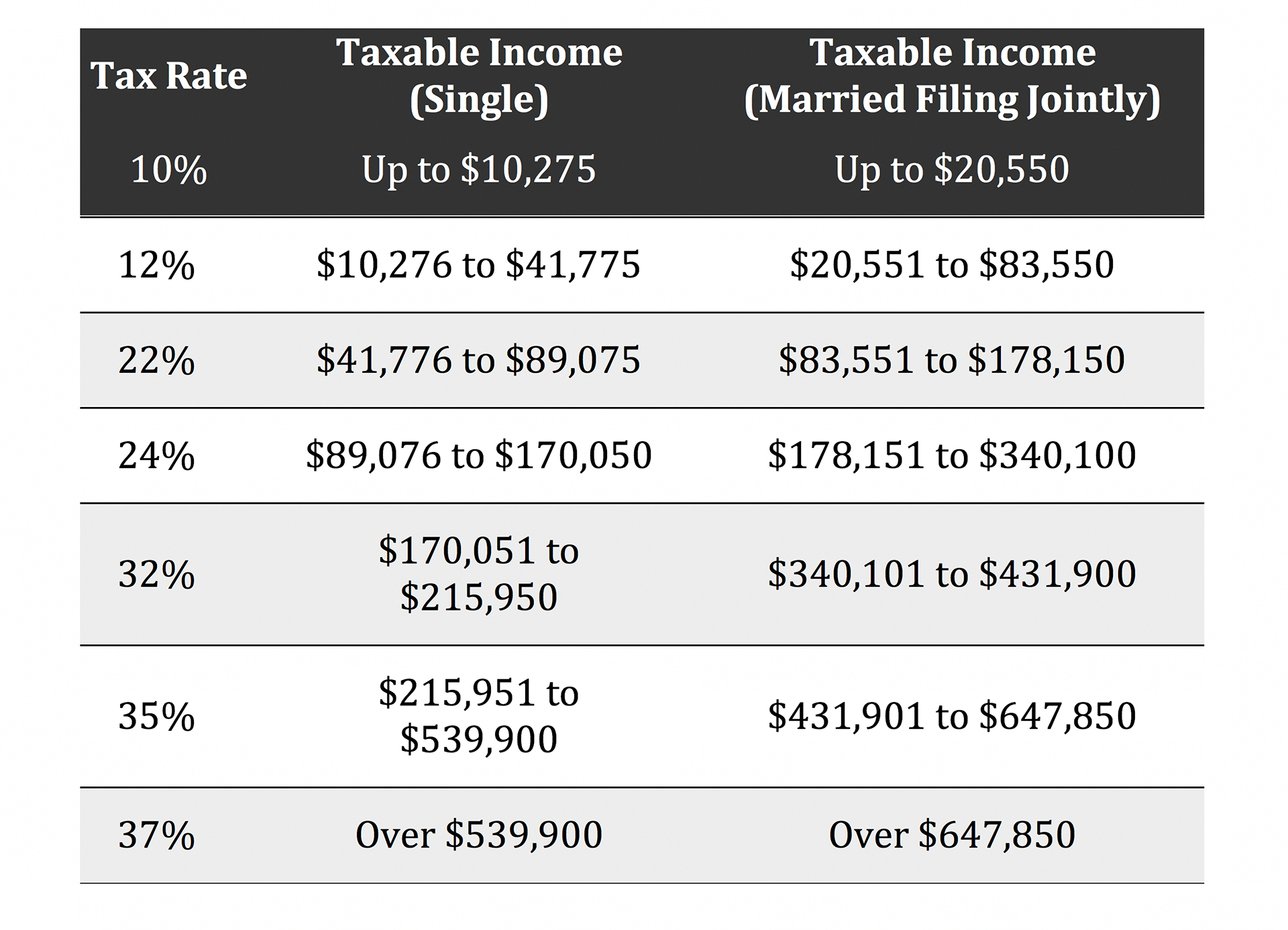

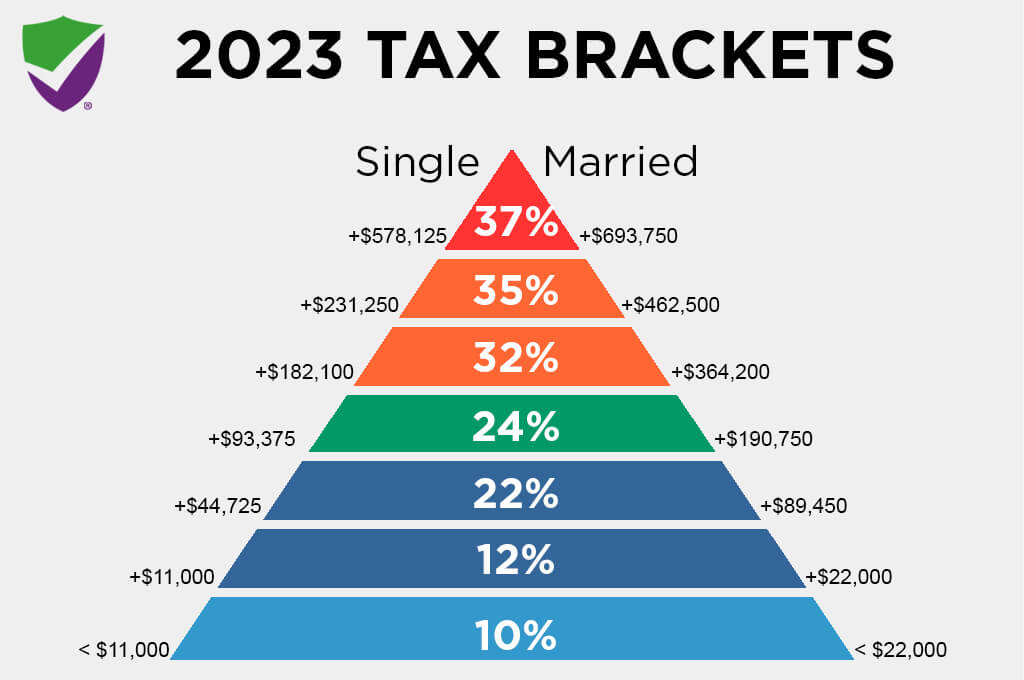

2024 Income Tax Brackets And Deductions Over 65. Below, cnbc select breaks down the updated tax brackets for 2024 and what. 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

10%, 12%, 22%, 24%, 32%, 35%, and 37%. There are seven (7) tax rates in 2024.

2024 Income Tax Brackets And Deductions Over 65 Images References :

Source: freddiytrenna.pages.dev

Source: freddiytrenna.pages.dev

2024 Standard Deduction Over 65 Tax Brackets Dinah Flossie, Your bracket depends on your taxable income and filing status.

Source: elvinaymelany.pages.dev

Source: elvinaymelany.pages.dev

2024 Tax Tables And Standard Deductions Married Jointly Benni Hortensia, Standard deduction 2024 if at least 65.

Source: issybcorella.pages.dev

Source: issybcorella.pages.dev

Standard Tax Deduction 2024 For Seniors Over 70 Merci Stafani, If you’re a single taxpayer age 65 and older, you can add $1,850 to $13,850 standard deduction.

Source: nixieqjessika.pages.dev

Source: nixieqjessika.pages.dev

2024 Tax Brackets And Standard Deduction Table Cate Marysa, Each year when you fill out your federal income tax return, you can either take the standard deduction or itemize deductions to reduce your taxable income.

Source: helgeqaustine.pages.dev

Source: helgeqaustine.pages.dev

2024 Tax Brackets And Deductions Dixie Frannie, 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

Source: verieewlola.pages.dev

Source: verieewlola.pages.dev

Federal Tax Brackets 2024 Single Mela Stormi, You pay tax as a percentage of your income in layers called tax brackets.

Source: www.linkedin.com

Source: www.linkedin.com

Understanding 2023 Tax Brackets What You Need To Know, The personal exemption for 2024 remains at $0 (eliminating the personal exemption was part of the tax cuts.

Source: hkglcpa.com

Source: hkglcpa.com

Tax Rates Heemer Klein & Company, PLLC, Each year when you fill out your federal income tax return, you can either take the standard deduction or itemize deductions to reduce your taxable income.

Source: www.kseattle.com

Source: www.kseattle.com

새해에 달라지는 연방 소득세 구간 5.4 인상 시애틀 한인 커뮤니티 케이 시애틀, You pay tax as a percentage of your income in layers called tax brackets.

Source: exovmobmx.blob.core.windows.net

Source: exovmobmx.blob.core.windows.net

Standard Deduction Chart Alabama at Sue Evans blog, For all 2024 tax brackets and filers, read this post to learn the income limits adjusted for inflation and how this will affect your taxes.

2024