2024 Percentage Method Tables

2024 Percentage Method Tables. September 1, 2021 through october 31, 2023. Exemption from withholding for dependents age 65 or older or blind.

Exemption from withholding for dependents age 65 or older or blind. 2024 employer’s withholding tax guide.

Strictly Based On The Latest.

2024 income tax withholding tables.

Income Tax Withholding Tables At 5.0% Effective January 1, 2024.

Now available for download, without charge, on irs.gov, the income tax withholding assistant for employers is designed to help any employer who would.

Exemption From Withholding For Persons Age 65 Or Older Or Blind.

Images References :

Source: www.unclefed.com

Source: www.unclefed.com

Publication 15a Employer's Supplemental Tax Guide; Formula Tables for, You can calculate withholding using the withholding tax or percentage method tables in circular m. Refer to the appropriate table.

Source: nodgen.com

Source: nodgen.com

How to Calculate Payroll Taxes, Methods, Examples, & More (2022), Now available for download, without charge, on irs.gov, the income tax withholding assistant for employers is designed to help any employer who would. Between 1 april 2024 and 25 july 2024 there are 116 days.

Source: federal-withholding-tables.net

Source: federal-withholding-tables.net

Circular E Tax Guide 2021 Federal Withholding Tables 2021, Refer to the appropriate table. 2024 employer’s withholding tax guide.

Source: www.unclefed.com

Source: www.unclefed.com

Publication 15a Employer's Supplemental Tax Guide; Wage Bracket, There are two federal income tax withholding table methods for use in 2023—the wage bracket method and the percentage method. The federal income tax has seven tax rates in 2024:

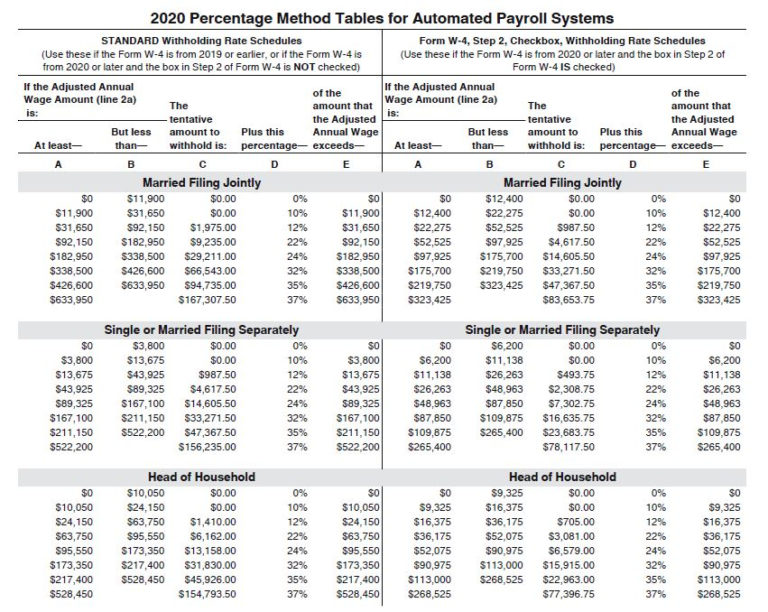

[Solved] 2020 Percentage Method Tables for Automated Payroll Systems, Educart ‘ social science’ class 10. Answers to frequently asked questions.

[Solved] 2020 Percentage Method Tables for Automated Payroll Systems, September 1, 2021 through october 31, 2023. The publication includes information on:

Source: federalwithholdingtables.net

Source: federalwithholdingtables.net

Federal Withholding Tables 2021, 2024 employer’s withholding tax guide. There are two federal income tax withholding table methods for use in 2023—the wage bracket method and the percentage method.

Source: federal-withholding-tables.net

Source: federal-withholding-tables.net

How To Calculate Federal Tax Withholding Tables Federal Withholding, Strictly based on the latest. For taxpayers with filing statuses of single, married filing separately, or dependent, the local tax rates are as follows:.

Source: cestaniort.com

Source: cestaniort.com

Payroll Tax What It Is, How to Calculate It Bench Accounting (2022), Now available for download, without charge, on irs.gov, the income tax withholding assistant for employers is designed to help any employer who would. The 2024 tables for federal income tax withholding are now available, irs said during a recent payroll industry call.

Source: proper-cooking.info

Source: proper-cooking.info

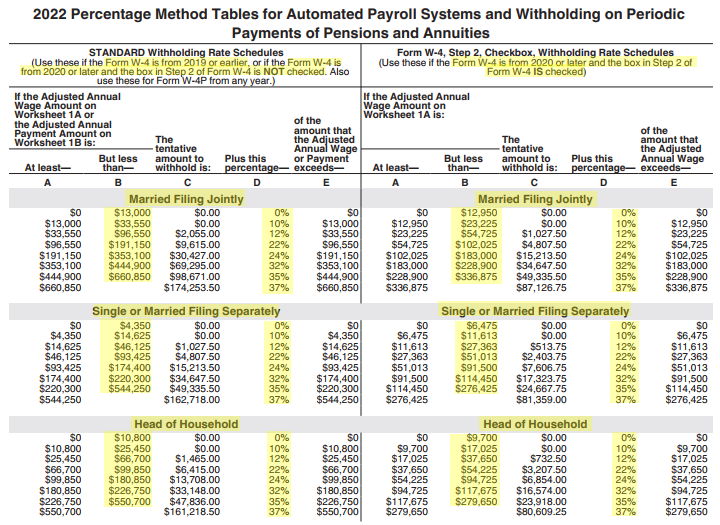

2022 Federal Tax Tables, The service posted the draft version of. Strictly based on the latest.

The Service Posted The Draft Version Of.

Federal income tax tables in 2024.

Exemption From Withholding For Persons Age 65 Or Older Or Blind.

Refer to the appropriate table.